tax act stimulus check error

President Trumps name is seen on a stimulus check issued by the IRS to help combat the adverse economic effects of the coronavirus. The IRS will calculate the correct amount if mistakes relating to the first and second stimulus payments are found on Line 30 of the 1040 or 1040-SR.

Your Third Stimulus Check Can Be Seized Here S What To Know Cnet

We have been working.

. My state and federal were both approved immediately like within the hour after I submitted them. If you do NOT check the box no bank account information will be sent and you will receive your stimulus payment as a check from the IRS. But the amount you claim could be adjusted by the IRS the.

Tax refund check from US Treasury and US currency 100 dollar bills. However there is also a chance that you miscalculated how much money you would receive. So I just filed my taxes online for free via tax act which IRSgov sent me to and one of the questions was did you receive a third stimulus for 1400 for a moment I was confused and didnt know there was a third stimulus so I said no.

After completing it I e-filed my taxes. Our bank partner complied immediately to ensure we. Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS are being redirected according to tax preparation companies affected by the mistake.

Delete state return if you have one. 2 days agoThe tax rebates would be directly tied to the amount of revenue collected from the higher tax and profits would need to climb higher than 110 in. A check was issued in the name of a single deceased person - the check was sent in error.

10 2021 we announced the IRS has committed to reprocessing stimulus payments directly to our customers impacted by the IRS payment error. The IRS asks the relatives to return the check. We filed with Tax Act and had our fees taken out of our return.

This decision was made after days spent advocating for our customers and pushing the IRS to rightfully send these much-needed stimulus dollars quickly to our customers. Once the correct amount is calculated the IRS. The IRS sent some of the stimulus payments to inactive or closed bank accounts.

In other words the IRS is advising that you do not add the CARES payment to the check or electronic transfer you submit to cover your tax liability. Stimulus payments for millions of TurboTax customers affected by the IRS error will be deposited starting today spokeswoman Ashley McMahon said in an email to NBC News. Turbo tax Not calculating stimulus correctly.

The IRS issued a stimulus payment based on the 2018 tax return information - that payment is an error. You can also refer to the IRS Statement Update on Economic Impact Payments I received my tax refund via check from the IRS how will I get my stimulus payment. Tax act stimulus check error Wednesday April 20 2022 The IRS began sending supplemental payments to people whose stimulus checks were based on their 2019 tax.

The correct amount of Recovery Rebate Credit is based on the information in your 2020 return only. The IRS did incorrectly send some stimulus payments to the wrong bank account. This IRS error caused some people to not.

It cannot be cashed out anyway as it would constitute federal fraud. You are supposed to pay it back. If correct check the box.

On the screen titled Verify that your bank account information is correct double check your bank account information entries. This years tax season has brought with it a new opportunity to collect any unpaid funds from previous rounds of federal stimulus checks. You should return the payment separately to your amended return.

I used Tax Slayer and am having the same problem. Many taxpayers can expect to. The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor We filed with Tax Act and had our fees taken out of our return.

Please verify that both of your dependents are under age 17 on your 2020 tax return and your income is showing below 150000. Please see Second Stimulus Payment Timing FAQs for the most up-to-date information regarding this issue. It told me my tax refund and the 3rd stimulus of 1400.

It is important to return the stimulus payment if you believe that you received it in error. I opted for the deluxe edition e-file for HR block I think it was 2999 plus 3999 to have the cost deducted from my refund. Upon realization of this error the IRS instructed financial institutions to return the funds to them which is required.

Im so confused on whats going on and our stimulus is no where to be found. Disaster Tax Relief box is automatically checked and I can not uncheck it. Yes if your 2020 has been processed and you didnt claim the credit on your original 2020 tax return you must file an Amended US.

The amounts you received as stated in your post would be correct if one of your. If you suspect an error you should report this to the IRS at 800-829-1040 and take steps to resolve this. Eric GayAP The IRS says it is fixing an error that prevented.

Tax Service Company Says IRS Will Reissue Stimulus Checks Sent To Wrong Bank Accounts January 11 2021 1004 AM CBS DFW DALLAS CBSDFWCOM - After the IRS sent millions of stimulus payments to. Individual Income Tax Return Form 1040-X to claim the creditThe IRS will not calculate the 2020 Recovery Rebate Credit for you if you did not enter any amount on your original 2020 tax return. People who do not receive their stimulus payment by the January 15 deadline will have to wait to claim their stimulus check as a tax credit.

The CARES Act created a stimulus check for many Americans and tasked the Internal Revenue Service to make those 1200. We use chase for our bank. Transcript says 14 and the check my payment or whatever its called shows status not available.

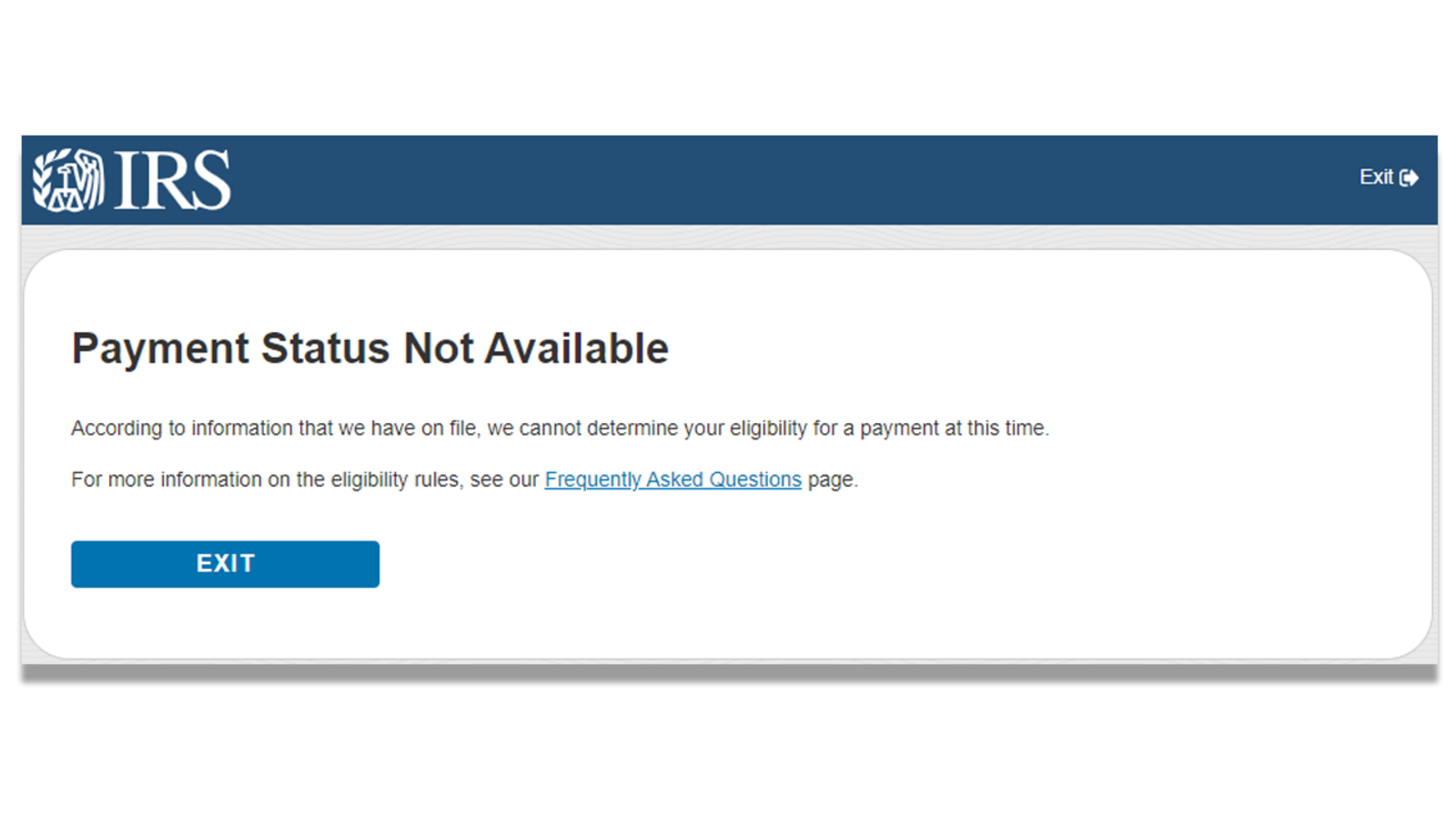

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 San Francisco

4 Best Online Proofreading Tools For Error Free Writing Verb Forms Grammar Mistakes Writing

The Second Stimulus Payment Is Happening Taxact Blog

Don T Lose That Irs Letter About Your Third Stimulus Check Here S What To Do With It Cnet

Stimulus Check Missing Some Waiting On 2nd Payment And Last Year S Tax Refund Wonder If Problems Are Related 6abc Philadelphia

Nonresident Guide To Cares Act Stimulus Checks

Filed As Resident In 2018 Left The Us Received Stimulus Check

Payment Status Not Available You Might Not Be Getting Your Stimulus Check After All

Stimulus Checks Tax Returns 2021

Second Stimulus Check Update Heroes Act Passes In The House Saturday May 16th Youtube Small Business Administration Hero Acting

Americans Struggle To Receive Missing Stimulus Checks

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York

Still No Stimulus Check One Of These Payment Problems Could Be The Culprit Cnet

The Irs Stopped Accepting Direct Deposit Requests On May 13 That Doesn T Mean You Won T Get A Check However Irs Filing Taxes Deposit

This Is Why You May Not Get The Third Stimulus Check Best Life Emprego Mudar Direito

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

Never Got A Second Stimulus Payment Here S What To Do Next And Other Faqs Forbes Advisor

10 Faqs About Claiming The 2021 Recovery Rebate Credit Taxact Blog

Irs Issues Warning Of Stimulus Check Scams How To Avoid Becoming A Victim